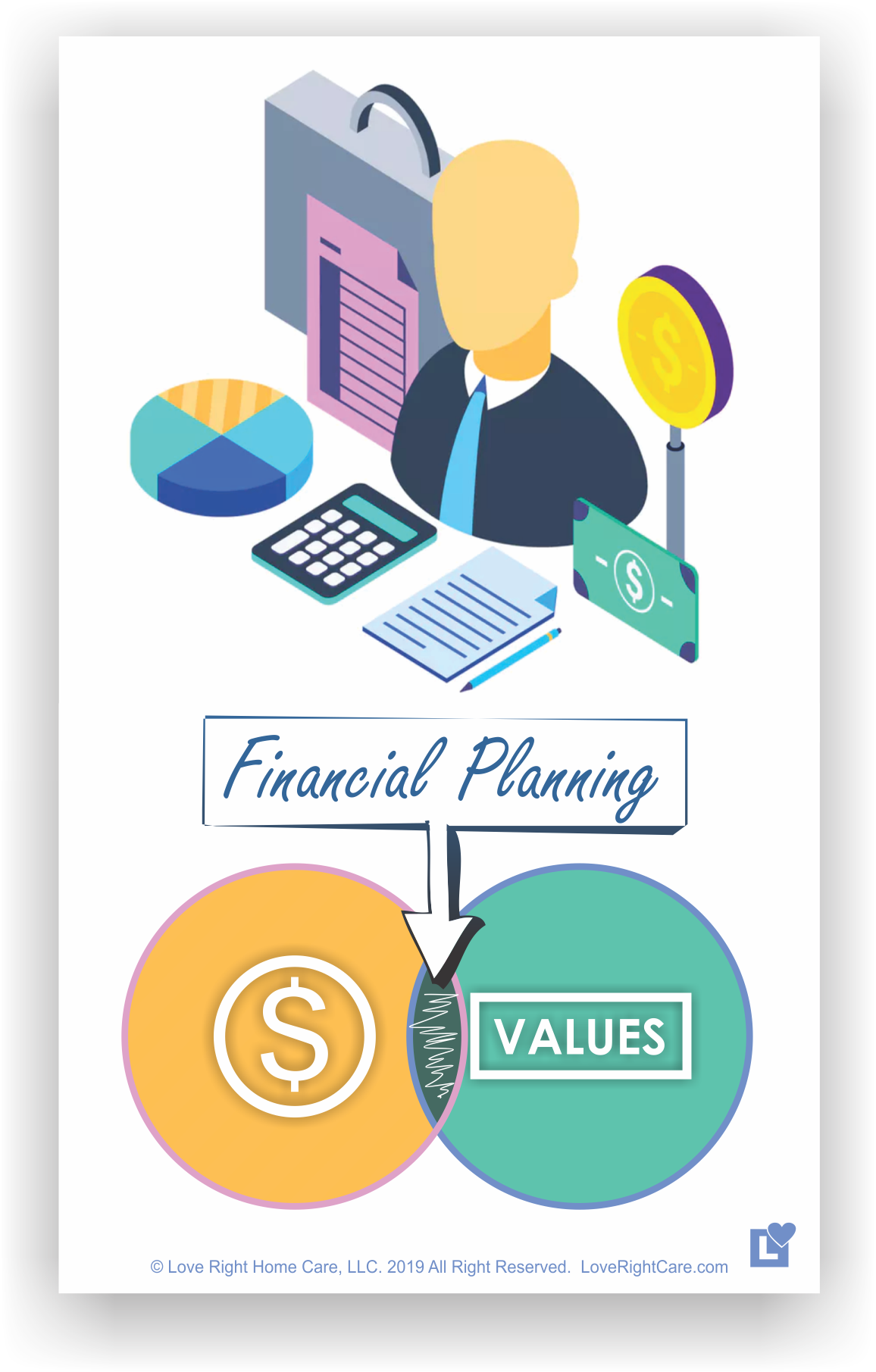

Financial Planning can be defined in numerous ways and many professionals can make themselves out to be a Financial Planner, Financial Advisor or Financial Consultant, among other definitions. The CFP Board defines Financial Planning as “the process of determining whether and how an individual can meet life goals through proper management of financial resources. Financial planning integrates the financial planning process with the financial planning subject areas.” That’s a lot of Financial Planning! But what does that mean?

Let’s Look at the First 6 Steps:

-

Establishing the client-planner relationship

-

Gathering client data

-

Analyzing and evaluating current financial status

-

Developing and presenting recommendations or alternatives

-

Implementing recommendations and

-

Monitoring these recommendations.

For caregivers, financial planning becomes more than just understanding the “numbers” and gets into balancing care for others with personal needs. Caregivers take on a major commitment and it oftentimes can come unexpectedly, as discussed in this previous Love Right blog post. This can introduce extra stress and could be a detriment to the caregivers finances. They may have to take time off from work, they could risk losing their job, or possibly miss out on opportunities for career advancements. It is important for the family caregiver to be proactive so they can either have family plans or create a work schedule that allows them to keep a job, but also provide care. Caregiving family members should be aware of the potential need to care for an aging parent so they can make family plans. This is when financial planning could be extremely valuable to the caregiver; balancing financial goals with the sacrifice of caring for a loved one. How do they financially support their lifestyle outside of providing care? If they are married, what does that mean for a working spouse and their career? Is he or she going to need to seek a higher paying job to support the family? How much should they maintain in an emergency fund? How do they continue to save for their own future? What impact will this have on their long-term financial goals? This is when working with a financial planner can be very valuable.

Note:

To me, the ultimate answer to the question of “what is financial planning?” is aligning your values with your financial resources and developing a plan around those. So, what is most important to you?

There are countless components to each step in the process.

Here is an idea of the breadth of covered areas involved in Financial Planning:

- Desired retirement age?

- How old are your parents -or- how old were they when they passed?

- Do you have life insurance?

- Are you taking advantage of all your company benefits?

- When was the last time you reviewed your Trust? (if you have one), how confident are you that you will meet your financial objectives? (if you have specific ones), are you saving for a child’s education?

- How do you plan on paying for long term care in the event you need it?

- Who will take care of your minor children, should something happen to you?

- How would you define “risks” of investing?

The entire process of financial planning is a means to an end. It is a process that offers individuals the opportunity to further understand their current financial resources and through the guidance of a professional, strategize on how to meet specific objectives.

“Financial Resources” can be a loose term.

In its simplest form, it’s money! Assets are acquired through money, we spend money, and we work to earn money. Every dollar we earn goes somewhere; whether it’s for life’s necessities, pleasures, or we can save it for the future. How do we determine what dollars should go where? We all have basic necessities in life such as food and shelter but once the basics are covered, how we spend becomes a choice.

Are you caring for a loved one and if so, how do you balance your own need to think about the long term ahead with providing the care your loved one deserves? It is just as important for those caring for others to take the time to focus on their own needs when it comes to planning for the future. There is life during and after providing care for a loved one.

Caregivers – Think about yourself

Your well-being is important too. The most common suggestions to maintain health for family caregivers are stress relief practices and time away from the caring situation, to decompress. Although, a common caregiver health neglect (you guessed it), financial health. Start the process and plan appropriately by connecting with a quality financial planner . Every small step is still a step in the right direction to care for yourself.

[…] taught you the essence of LOVE – In the typical family, the Mother spends the most time with their children loving them […]